Investment in AI computing power is driving the global optical communication industry into a high-growth cycle. Global data center capital spending soared by more than 50% in the first half of 2025, directly boosting demand for high-speed optical modules. The demand for 800G is clear, and 1.6T technology will enter commercial use on a large scale in 2026. The market is structurally divided: the traditional telecommunications access market is under pressure, while the transmission network market is recovering strongly under the procurement of cloud service providers, and the convergence of IP and optical networks is a definite trend. Optical communications, as the cornerstone of AI computing power, are expected to continue their high prosperity for a long time.

Ai-driven demand surges, data center market "rides far ahead"

The AI race has become the most powerful engine in the industry, the report says. Global data center capital spending continued to grow at a high rate of over 43% year-on-year in the second quarter of 2025. NVIDIA CEO Jensen Huang's estimate of "trillions of dollars in AI infrastructure investment" is becoming a reality: the recent massive collaboration among giants like Microsoft, Oracle, and Meta has not only reshaped the tech landscape but also created massive demand for high-speed optical interconnects.

This demand is most directly reflected at the optical device end. The world's top optical device manufacturers, including Coherent, Lumentum and INnolight ,DFTTELECOM, are expected to see a significant 52% year-on-year increase in revenue this quarter. There is a consensus in the market that demand for 800G optical modules is certain to double, and 1.6T technology has ended the sample stage, with a steeper growth curve and is set to enter the first year of large-scale commercialization in 2026.

Telecom and transmission market: Structural differentiation, IPo optical convergence becomes mainstream

In contrast to the boom in data centers, the growth of the traditional telecommunications access market continues to be under pressure. In the first half of 2025, China's three major operators' capital expenditures dropped 16.5 percent year-on-year, and global telecommunications capital expenditures also showed weakness. Operators are reallocating investments from full coverage construction to capacity, quality and automation improvements related to AI computing power.

Meanwhile, the transmission network market is recovering strongly with strong purchases from cloud service providers. The global optical transmission market grew 14 percent year-on-year in the second quarter of 2025, ending six consecutive quarters of decline, Dell 'Oro reported. Among them, data center interconnects and IP over DWDM technology became the core drivers. Cloud service providers' direct purchase of WDM systems soared by 60%, driving shipments of pluggable optical modules such as 400ZR/ZR+ to increase by more than 50% quarter-on-quarter. According to an authoritative industry survey by Heavy Reading (now part of Omdia), the convergence of IP and optical networks has become an irreversible industry trend, and nearly 60 percent of high-speed pluggable optical modules will be directly used in routers over the next three years.

Technology Frontier: 1.6T and CPO compete to shine, industry synergy accelerates

At the technical level, the iteration speed is unprecedented. International conferences such as ECOC 2025 have sent a clear signal that 1.6T and 200G/ channel technologies have become the new benchmarks in the industry, and related chip and module solutions are being released intensively. In the more advanced packaging field, the competition between the two technical paths of co-packaged optics and linear pluggable optics is becoming increasingly clear, and major manufacturers have achieved remarkable results in reducing power consumption by 50%.

In addition, revolutionary technologies such as hollow-core fiber and multi-core fiber are moving from the laboratory to mass production to address future bandwidth and latency bottlenecks. The open network ecosystem is also maturing, and the multi-vendor interoperability showcased by 35 companies marks the industry's shift from technological competition to collaborative development, providing customers with more flexible and decoupled options.

The entire industrial chain benefits, and mergers and acquisitions build technological barriers

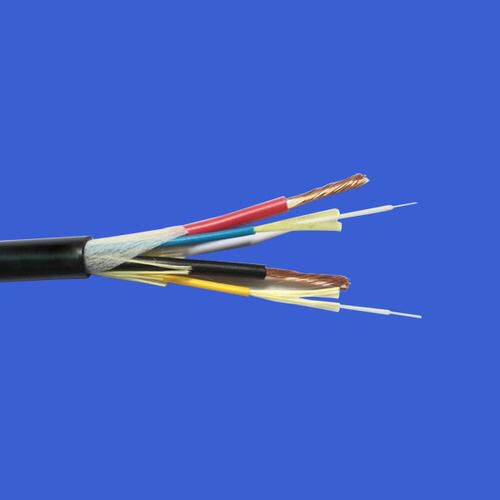

This round of growth dividends has benefited the entire industrial chain. The report covers chipmakers, equipment makers and fiber optic cable makers, all of which are expected to see double-digit year-on-year growth in revenue. To seize the technological high ground, industry mergers and acquisitions are exceptionally active, such as Credo's acquisition of Hyperlume for optical interconnect technology and Ciena's acquisition of Nubis for CPO, indicating that giants are rapidly integrating next-generation core technologies through capital means.

Outlook: The long-term trend is clear, and optical communications are at the top of the AI wave

Despite predictions that the growth rate of spending by hyperscale vendors may slow after 2026, analysts note that the long-term construction around AI infrastructure is just getting started. Under the grand vision of $3-4 trillion investment, optical communications, as the cornerstone for carrying and connecting global computing power, are expected to continue their high boom cycle for a long time. A new era defined by AI computing power and supported by optical communications has begun.

1 commentaire

AI computing power makes a great revolution for global optical communication industry. it is so important and you should know more about AI backend network and development trend.